“Value Investing can be boiled down to the act of buying a dollar for 50 cents or less .”

– Bruce Greenwald

The company i am about to go into more depth on (Pargesa Holding S.A.) initially came to my attention during a conversation a few months back with David Waters, who analyzes some very interesting companies at OTC Adventures.

Upon looking further into the company, what i found is that not only are they currently valued in the market at a very significant discount to NAV, but they own minority stakes in a treasure trove of world-class businesses. There is plenty to go over, from Pargesa’s complicated holding company structure to both the quantitative and qualitative aspects of their holdings to the people behind the company whose names will likely be recognizable.

Pargesa Holding S.A. (Paribas-Geneve SA) is a Geneva, Switzerland based holding company which is active in various industries and service sectors through its holdings in a number of operating companies. The company is jointly controlled (50/50) through the Dutch holding company Parjointco NV, which was created in 1990 after an agreement between Power Corp. of Canada, which is majority owned by the 6th wealthiest individual in Canada Paul Desmarais Sr. and his family and Frere-Bourgeois, which is the privately held Belgian holding company of Albert Frere whom is purported to be Belgium’s wealthiest man.

But wait, there is more (i told you things were going to get complicated) Pargesa owns most of its minority stakes in its operating businesses in-directly through yet another holding company Groupe Bruxelles Lambert which is publicly traded on the Brussels Stock Exchange in Belgium. All told, the organizational chart looks like this:

In order to fully comprehend Pargesa as it stands today, one must take a look back at it’s storied history beginning with its formation in 1981 as a wholly owned subsidiary of the French bank Compagnie Financière de Paris et de Pays Bas or BNP Paribas as it is better known today.

Paul Desmarais Sr. began diversifying his holdings into Europe in the 1970’s. One of his first forays was an investment in Paribas of approx. $20 Mil. in exchange for a 2.3% stake in the bank. It was through this investment that he initially became acquainted with Albert Frere who was also a substantial minority shareholder in the bank. In 1982, then socialist French President Francois Mitterand drew up plans to nationalize Paribas. To sidestep the French government’s plans, Paribas created a Geneva, Switzerland based holding company into which they transferred the banks assets, thus shielding the bank from the government’s grab. By 1990, Desmaraise working in tandem with Frere gradually increased their stake in Pargesa until they acquired control, holding 50% of the company’s shares and 56.5% of it’s voting rights.

Sometime in the early 1980’s Pargesa bought a 35% stake in Groupe Bruxelles Lambert (GBL) injecting over $2.5 Bil. Francs into the investment holding company. GBL’s rich history dates all the way back to the 1860’s and Leon Lambert and his family, which Mr. Clemence Scholl does a great job of chronicling in his Seeking Alpha article. Over the subsequent decades that followed, Desmarais and Frere gradually divested GBL’s substantial holdings in large Belgian national companies and plowed the proceeds into large multi-national blue chip companies.

Today GBL is 50% owned (52% voting rights) by Pargesa Netherlands B.V. which is a wholly owned subsidiary of Pargesa Holding S.A. which is in turn 56.5% owned (76% voting rights) by Parjointco N.V. which is jointly controlled (50/50) by Power Corp. du Canada & Groupe Frere-Bourgeois which are respectively the holding companies of Paul Desmarais Sr. and his family and Albert Frere (got that?).

Now that we know a bit of the background of Pargesa, let’s get to know more about its present holdings which are every bit as fascinating as it’s past.

Shareholdings

Groupe Bruxelles Lambert is the Belgium-based holding company which directly owns significant minority stakes in six large European based, multi-national companies which operate in a diversified range of sectors. GBL also owns an private equity portfolio which is comprised of a number of different businesses worth approx. $317 Mil. EUR as of Dec. 31, 2011. Pargesa owns 50% of GBL’s common shares and has a 52% voting right in the company.

GBL’s main holdings consist of:

Total is one of the largest integrated oil and gas groups in the world. It’s activities cover both the upstream (exploration, development, production) and downstream (refining, distribution, transport) components of the industry. Combined, the company has operations in approx. 130 countries.

The upstream component has exploration and production activities in more than 40 countries and the downstream end operates primarily throughout Western Europe, Africa & Asia. It owns stakes in over 20 refineries with a capacity of approx. 2.1 million barrels a day and sells more than 3.6 million barrels of refined products a day. The company also has a growing chemicals business which is a leader in most of the markets in which it conducts business and is divided into two separate divisions – Refining Chemicals & Supply Marketing, which is focused on promoting various oil by-products globally. Total primarily derives its revenue of $184.6 Bil. EUR from Europe (67%) but it’s Asian operations now make up approx. 16% of its annual turnover and growing. North America and Africa make up the remainder. The company earned $12.2 Bil. EUR in fiscal 2011.

GBL owns 4% of the company’s share capital which amounts to approx. $3.3 Bil. EUR as of June 1, 2012 at market.

GDF Suez is a global energy group with activities in gas, electricity, energy and environmental services. These businesses give the company a presence in the entire energy value chain, from electricity and natural gas, to upstream and downstream. Its activities cover the purchase, generation and sale of natural gas and electricity as well as the transport, storage, distribution, development and operation of major natural gas infrastructures.

The company was formed on July 22, 1998 as a result of the merger between Suez and Gaz de France creating the world’s second largest utility company, with total revenue exceeding $90.7 Bil. EUR and Net Income of $4 Bil. EUR as of 2011. GBL’s equity stake of 5.2% amounts to $1.98 Bil. at market as of this writing.

Pernod Ricard is a co-leader in the global wine and spirits market. The company has a presence on every continent and produces and distributes 14 brands of champagne and spirits, 4 brands of “premium wines” (none of which i can name since i don’t drink) as well as 18 other brands which are leaders in their respective markets, including some more familiar names such as Kahlua, Chivas Regal and Absolut among others.

The company has built up its current portfolio of brands both organically, and more recently through acquisitions such as Segram in 2001 and Vin&Sprit in 2008. Pernod had turnover of $7.6 Bil. in fiscal 2011, with net income of over $1.04 Bil.

GBL reduced it’s equity stake in Pernod Ricard in March of this year by 2.3% (netting a capital gain of$240 Mil. EUR on the disposal, $125 Mil. of that being Pargesa’s share) leaving it with a 7.5% remaining interest. At market, this stake is worth approx. $1.5 Bil. as of the end of May.

Larfarge S.A. is a leading industrial company and the largest supplier of building materials in the world. You may have seen their trademark white cement trucks on a road near you, as they are the largest producer of cement in the world. The company is also the second largest producer of Aggregates (composite materials) and the fourth largest producer of ready-mix concrete globally.

Now, despite deterioration in the building material industry economic cycle, global cement consumption has actually grown by an avg. of 5% over the past twenty years. This demand according to Ernst & Young is expected to remain steady and slightly increase in the coming decades, being led by growing demand in emerging markets (China, India & Africa) whose collective share of the global cement consumption has grown from a 70% in 1990 to over 90% as of 2010. Why is this important? Because Lafarge is strategically positioned in these growth markets, holding over 50% of the cement capacity in Asia, 61% in Latin America and approx. 71% of the total cement capacity in emerging markets as a whole.

This indicates a business that not only enjoys stable cash flow at the present from their operations in Europe and the Americas, but an increasing flow of cash once demand begins accelerating from Asia and Africa over the next ten, twenty years and beyond as they are positioned to be the primary beneficiary of this shift.

Lafarge had revenue of $15.2 Bil. EUR in 2011, with net income of $593 Mil. EUR. GBL’s 21% equity stake in the company has a market value of approx. $1.78 Bil.

Imerys is a French multi-national company, it is a constituent of the CAC (French Bourse) and the world leader in minerals processing with 245 industrial sites in over 47 countries.

The company processes, enriches and combines a range of minerals such as pigments, red clay, ball clay, feldspar and quartz among others which are sold to industrial customers and used in everything from ceramics and abrasives, oil and gas exploration to steel, cement, bricks and paper and packaging.

The majority of Imerys’s turnover comes from Wesetern Europe (approx. 48%) but it’s emerging markets operations are quickly gaining steam with a little over 27% of the company’s revenue coming from China and India in the past year. Further, the company is interested in increasing their revenue from emerging markets as it is “focused on organically growing it’s portfolio in these markets, combined with a very selective acquisition policy.” for the coming half decade (2012-2016).

Imerys had total revenue of $3.6 Bil. EUR in fiscal 2011, while its net income from operations stood at $303 Mil. EUR. for net margins of approx. 7.7% which is only slightly down from their net margins of a decade ago of 8.3% in 2002., similarly un-adjusted return on equity stood at a respectable 12.8% (considering the business’s size) for the past year as compared to 9.5% in 2002, indicating a stable and predictable business.

Imerys’s results are fully consolidated into Groupe Bruxelle Lambert’s financials as GBL owns 57% of the company’s share capital, which is valued at $1.64 Bil. at market.

Suez Environment Company S.A. is the world’s second largest water company. The company was spun off from GDF Suez S.A. (Described above) in July 2008. Suez’s business is very simple, their operating model consists of public/private partnerships with government municipalities which gives them the exclusive right to manage water distribution and treatment systems and generate revenue therefrom.

Overall, Suez operates in three distinct segments:

– Water Sector: This consists of the operation and management of water production and treatment plants primarily in Europe and Spain, under the Lyonnaise des Eaux, Ondéo Industrial Solutions, Safège, Degrémont, United Water and Agbar banners.

This division operates 1,200 drinking water production plants and 2,300 water treatment facilities as of 2011, which cover the water needs of more than 90 million people.

– Waste Sector: Waste collection and treatment as well as management of industrial landfill sites. This group treats over 42 million tonnes of waste on an annual basis and serves the waste collection needs of nearly 63 million people.

– International: This division comprises the activities of Degrémont, which designs, constructs and operates water production plants on a global basis with operations in the US (under the United Water banner) China, Australia and the Middle East.

While economic activity may remain subdued in the large markets in which the company does business and increasing inflation will have a negative effect upon the company’s input costs going forth, Suez will likely achieve modest top-line growth through slight price increases while cash generation will remain stable and predictable, which is a recurring theme (a good one:) among Pargesa’s businesses.

Further, the long-term secular trends of global water consumption favor the company as an increasing population will drive demand for modern water production and treatment.

Suez’s turnover for the last year came in at $14.8 Bil. EUR. Up from $12.0 Bil. EUR in 2007, with net income of $323 Mil. EUR, this is down from $676 Mil. in 2007, reflecting higher operating costs as mentioned above. Net margins confirm this, falling from 5.9% five years ago to 2.1% at present.

GBL owns 7.2% of Suez, with a market value of $357.8 Mil. as of this writing.

Ergon Capital Partners

GBL also has a private equity arm in Ergon Capital Partners S.A., which the group established in February 2005 in partnership with Parcom Capital, a wholly owned subsidiary of ING Group.

ECP’s funds own controlling stakes in an impressive collection of ten businesses as of December 31, 2011, including De Boeck (the largest academic and professional publishing group in Belgium), Benito Artis (the leading designer and distributor of street furniture in Spain) and Seves Group (the world’s leading manufacturer of electric insulators and glass blocks for architectural and interior design applications).

The others are no less impressive and include Stroili Oro, which is one of the leading jewelry chains in Italy and Western Europe and Nicotra-Gebhardt, which is a leading niche manufacturer of fans for commercial buildings and industrial ventilation with production facilities in eight countries.

The remainder of ECP’s holdings can be seen here: http://ergoncapital.com/investments/summary_table.php

The private equity firm’s results are fully consolidated in GBL’s financials. ECP’s portfolio of businesses had an estimated net asset value of approx. $317 Mil. EUR as of December 31, 2011. ECP’s value will not have much of an impact in our valuation of Pargesa, only insofar as it undoubtedly contributes to GBL’s net worth.

Valuation

Liquidation Value

First, here is a composite summary of Pargesa’s flow-through interest in the businesses highlighted above:

Based on the flow-through interest shown above, we can determine the current market value (as of June 1, 2012) of each holding:

– Groupe Bruxelles Lambert S.A.: $4,020 Bil.

– Imerys S.A.: $812.25 Mil.

– Lafarge S.A.: $880.95 Mil.

– GDF Suez S.A.: $963.30 Mil.

– Suez Environment Company S.A.: $158.76 Mil.

– Total S.A.: $1,607.4 Bil.

– Pernod Ricard S.A.: $995.19 Bil.

Total: $9,437,850 Bil.

*All figures are in EURNow when we convert our total into CHF (which is the primary currency used by Pargesa) we arrive at a figure of approx. $11, 340,793.77 Bil. CHF. If we simply deduct the total liabilities of Pargesa (as of December 31, 2011) from this figure we come to a value for Pargesa of: $4,609.4 Bil. CHF

To be more accurate, can anyone identify what we are missing? The answer is: The remainder of Pargesa’s adjusted current assets, which breakdown as such:

– Cash: $1,940.5 Bil.

– Financial Assets Held For Trading: $38.2 Mil.

– Trade Receivables (discounted by 50%): $355.8 Mil.

– Inventories (discounted by approx. 36%): $542.9 Mil.

– Other Short-Term Assets (discounted by 90%): $37.7 Mil.

Total Current Assets: $2,915.1 Bil.

*All figures are in CHFWhen we reconcile these figures our adjusted NCAV amounts to:

Total Current Assets (adjusted & including available for sale financial assets): $12,352.9 Bil. – Total Liabilities: $6,731.3 Bil. = $5,621.6 Bil. CHF

This compares to today’s (June 1, 2012) market value for Pargesa of only: $3,953.3 Bil. CHF

Thus, we see that not only is Pargesa valued well below its worst case scenario liquidation value but it is also currently selling for below the value of its shareholdings (available for sale financial assets) minus all liabilities alone. A European fire sale indeed!

Evidently, there is a large margin of safety present for investors at today’s prevailing market price. But what are the inherent risks? As every investment has a few (some more than others).

When inverting, which is a concept first invented by the German mathematician Carl Gustav Jacob Jacobi in the 1800’s which states that many mathematical and as Charles Munger attests, investment problems can be solved by expressing them in reverse and attempting to find a clear reasoning as to why even today’s low prevailing market price would not be justified for the business as a whole, i am admittedly stumped.

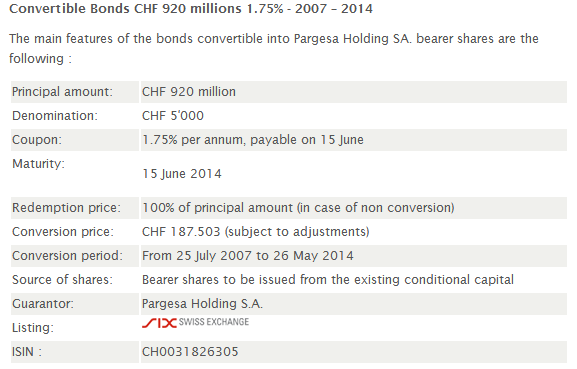

When one considers the company’s debt load (both short and long-term)* which amounts to a total of $4,978.9 Bil. CHF the majority ($4,187.1 Bil. CHF) is long-term debt with only ($791.1 Mil.) in short-term indebtedness. This amount is covered by earnings from associated companies and net dividends from investees ($771.3 Mil. CHF in fiscal 2011) in 6.5 years which falls just above the five-year rule. However, this test is somewhat superficial since all of the holding company’s debt is in the form of outstanding notes and bonds, as of December 31, 2011 Pargesa had no outstanding bank debt.

*Includes consolidated debts of GBL & ImerysThe more prudent test in this case would be interest coverage of Pargesa’s three outstanding bonds, which breakdown as such:

As one can see, the total annual interest expense from these issues comes to only $30.05 Mil. CHF per annum, which is covered by current adjusted income (to exclude accounting charges) about 26 times.

Further, when it comes to the company’s total pension liabilities, these amount to only $280.6 Mil. CHF and are easily covered by the company’s current cash on hand.

A third cause for concern in some cases could come from financial derivative exposure, but in this particular case Pargesa only has a grand total of $77.2 Mil. CHF in hedging derivative liabilities, which are primarily attributable to Imerys who utilizes currency swaps and foreign-exchange options to hedge risks between the EUR and CHF.

A final question which could veritably be posed regards the general stock market in Europe and more presciently if its overall valuation will drop as a result of the economic turmoil within the EU and what effect that will have on Pargesa and it’s partially owned businesses which are all listed on various bourses in Europe.

For the answer to this question, i think it prudent to refer back to Benjamin Graham:

“Our opinion is that for the investor it is better to have his money invested than it is to feel around for the bottom of the securities market. And if you can invest your money under fair conditions, in fact under attractive specific conditions, I think one certainly should do so even if the market should go down further and even if the securities you buy may also go down after you buy them.”The only thought i wish to add to this, is that while the economic challenges in the European countries in which Pargesa’s constituent companies do a majority of their business should not be understated and will have a very definite negative impact on their operating results going forth, the majority of each’s franchise and competitive advantages are durable to the extent that their intrinsic values will not only hold up, but significantly increase over the long-term in my opinion.

__________________________________________________________________________________________________

Appendix

– Imerys Corporate Connections Paper

– Cement”-ing growth Whitepaper By Ernst & Young, India.

– Value Investing Lecture Series By Benjamin Graham

– Invert, Always Invert By Margin of Safety

looks like you are confusing € and $ when you calculate flow through interest, for example, GBL’s market cap is €8 billion, not $8 billion which seems to be what you are using.

or maybe you are anticipating that € and $ will be at par soon, which is not completely unthinkable……

regards

rijk

Hi rij,

Thanks for the keen observation.

If you look just below the stated market values of each holding, you will see that i note the figures are all in EUR.

Hi,

Why have you included GBL in your calculation? Isn’t that just a holding company that owns shares in the underlying businesses?

Hi Floris,

I included GBL in the calculation simply because they have over $737 Mil. EUR in cash alone on their books as well as adjusted current assets of approx. $2 Bil. EUR, this does not include any of the holdings in the businesses mentioned, any non-current assets or equity in private businesses via their PE portfolio.

If we were to perform a NCAV for GBL alone, their liquidation value would be much greater than their current market value. I figure they are worth close to $4 Bil. EUR If one simply takes into account just their cash, adjusted total assets (minus their business holdings) and private equity holdings alone.

Hey Theodor, Thanks for your response. I still can’t figure it out. If i look at the balance sheet of GBL I see a net debt position, not a cash surplus (after subtracting the cash on the BS). Sure the liquidation value (if orderly) would be higher than the market cap but thats just due to the ownership stake in the listed companies. Can you specify where you get the $4b from? The main value is see is just the stakes in the listed companies, not any other liquid investmnets. The balance also reflects the consolidation of Immersys not economic interest in other entities. Adding Immersys as a listed stake and looking at the NCAV of GBL looks to me like double counting, but then again I could be wrong (wouldnt be the first time!).

Hi Floris,

I think the most plausible scenario would be for Pargesa to merge into GBL or vice versa, thereby eliminating a tier on the holding co. apparatus. This is partly what i am hoping for since such an event may help the company become better understood by market participants and thereby help it realize at least its breakup value.

Even if one is to eliminate GBL from the equation and count only the flow-through interest accruing to Pargesa from the remaining businesses, the discount (although not as large) would still be in place compared to its current market value.

And this would be after deducting all of the company’s liabilities, although most of its liabilities are circumstantial and not fixed (no outstanding bank debt & even the greater part of its outstanding bonds are convertible into bearer shares at the time of maturity).

This design is incredible! You obviously know how to keep a reader amused.

Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Excellent job.

I really loved what you had to say, and more than that, how you presented it.

Too cool!